The February 14 2020 implementation of the phase one deal between the United States and China established new US tariffs on imports from China for the foreseeable future. China retaliated again on Friday with more levies on US goods.

Trump S Fall 2019 China Tariff Plan Five Things You Need To Know Piie

Trump S Fall 2019 China Tariff Plan Five Things You Need To Know Piie

Across multiple rounds tariffs were levied on essential medical supplies from China.

Tariffs against china. Trump is threatening tariffs of 10 on 300bn of Chinese imports. Since China is a member of the WTO imports from the United States are assessed at the MFN rate. The US has now slapped billions of dollars on tariffs on Chinese goods.

China Tariff Trade Barriers. President Donald Trump in January 2018 began setting tariffs and other trade barriers on China with the goal of forcing it to make changes to what the US. China Customs assesses and collects tariffs.

China Section 301-Tariff Actions and Exclusion Process. The second set contains 284 proposed tariff lines identified by the interagency Section 301 Committee as benefiting from Chinese industrial policies including the Made in China 2025 industrial policy. Trump has touted his tough stance on China trade as a key.

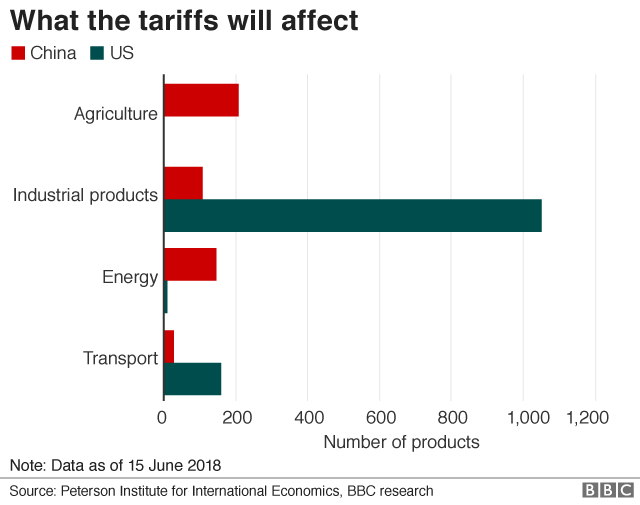

Then the US. In this article well review the products that are affected by these tariffs and what you can do about it. Tariffs of up to 25 remain on some 370 billion worth of Chinese goods imports annually.

Trumps China Tariffs The List of Products Affected and What You Can Do. 34 Billion Trade Action List 1 16 Billion Trade Action List 2 200 Billion Trade Action List 3 300 Billion Trade Action List 4 COVID Exclusions. A three-person panel of WTO trade experts said Washington broke with global regulations in 2018 when it slapped more than 200 billion in levies on a.

These 284 lines which cover approximately 16 billion worth of imports from China will undergo further review in a public notice and comment process including a public hearing. On August 2018 the Trump Administration put additional tariffs on 16 billion worth of products. Import tariff rates are divided into six categories.

Average US tariffs on imports from China remain elevated at 193 percent. Tariffs against China were authorized under Section 301 of the Trade Act of 1974 which empowers the president to levy tariffs and other import restrictions. A tariff is essentially a tax or duty that has been imposed upon a particular class of imports or exportsTariffs worldwide are increasingly being imposed again against goods from China after they were usually mutually reduced over the years.

These tariffs are more than six times higher than before the trade war began in 2018. Starting January 1 2019 the level of the additional tariffs will increase to 25 percent. The list contains 5745 full or partial lines of the original 6031 tariff lines that were on a proposed list of Chinese imports announced on July 10 2018.

The US president has expanded tariffs against China putting a trade deal in doubt. And China have been embroiled in an escalating tariff war since 2018. These tariffs cover 664 percent of Chinese exports to the.

Is this an effort to gain more leverage in a potential final lap of trade talks or a reflection of genuine lack. The White House already levies tariffs of 25 on 250bn of Chinese goods. The choice of Chinese investment conditions as.

Announced tariffs in retaliation against against Chinas treatment of US. How to Navigate the Section 301 Tariff Process. Trump used tariffs as a negotiating tactic meant to hurt Chinas economy and pressure Beijing to agree to a new trade deal that addresses unfair trade practices such as intellectual property.

October 18 2019 - USTR Statement. The World Trade Organization has ruled that tariffs the US imposed on Chinese goods in 2018 triggering a trade war were inconsistent with international trade rules. General rates most-favored-nation MFN rates agreement rates preferential rates tariff rate quota rates and provisional rates.