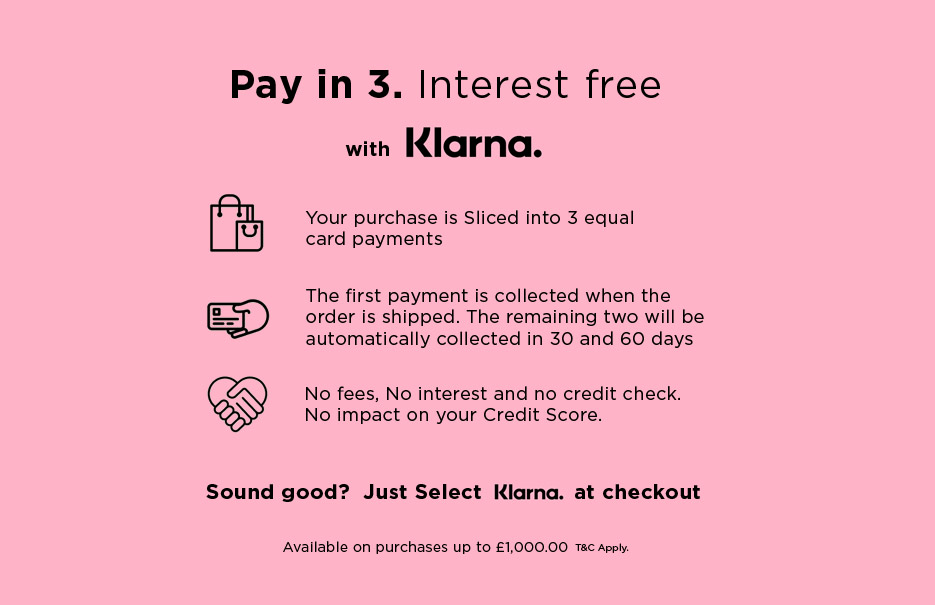

The number of days depends on the store you are buying from always check the terms to make sure you dont miss a payment. Downloading the Klarna App.

Does Klarna Impact My Credit Score Klarna Uk

Does Klarna Impact My Credit Score Klarna Uk

It says that it does a soft credit check which doesnt affect credit scores.

Does klarna run your credit. Deciding to Pay in 4 interest-free installments. Klarna is a buy now pay later service which gives you 14-30 days to pay for goods and services online. Your score can be impacted negatively making it harder for you to take out credit in the future.

This will only be visible to you and wont affect your credit score. Financing formerly known as Slice it is Klarnas only regulated credit product with payment plans typically from 6-36 months. When you choose the Pay Later options with Klarna theyll run a soft search against your credit report.

However if youre late with a payment your credit file could be affected. Klarna insists that if you use the service to pay later you wont have a credit impact however if you pay in instalments you could see your rating affected. In turn this lowers your credit score.

However most Klarna financing requires an application complete with a credit check which will result in a hard pull of your credit report. If you choose to pay in four installments youll only undergo a soft credit inquiry which doesnt affect your credit scores. Want to use a POS loan to build credit.

This is Klarnas only regulated credit product with payment plans typically lasting 6-36 months. The shopper must proactively complete be approved for and sign a regulated credit. It runs a hard credit check for those.

At the moment they dont report missed payments to credit. In this instance there will be a record of the search on the customers credit file with the CRA. That means - to date - a customers credit score.

Your score isnt affected so you can apply for as many as you want. Lenders will not see this and it will not affect your credit score. Similarly missing a payment for the Pay Later option wont hurt your credit score because Klarna doesnt report these payments to credit reference agencies CRAs.

The Swedish service has proved extremely popular for fashion shoppers who can try before they buy. However if youre interested in using Klarnas six to 36-month financing option youll go through a hard credit check which will show up as an inquiry on. Signing up to use Klarna.

We dont think anyone should be financing things like clothes. The one exception is Klarna. Klarna is not a good idea if you.

Klarna does not report on-time payments to the credit bureaus though it. We will not perform a credit check on you when. Klarna and ClearPay told The Sun that no customers credit scores have been impacted by using their pay later or pay 30 days later products even if they have failed to pay on time.

If you choose to four interest-free installment payments the. For installment and pay-later purchases Klarna runs a soft credit check which does not impact the consumers credit score or appear on their credit report. Preferring to Pay in 30 days.

We will perform a credit check when. When you apply for an account with Klarna it performs a soft credit check that will not impact your score. Similar to all traditional finance providers who offer products of this nature with the customers consent a hard credit check is undertaken.

A soft credit search is essentially used to check that the information you have provided is correct and will only be visible to you on your credit report. In this instance there will be a record of the search on the customers credit file with the CRA. Actually its possible to get credit with no prior history.

Klarna reviews your credit when you make a purchase. But 80 million people are using Klarnaso if youre going to use it at least make sure you know what youre getting into. Klarna offers different ways to pay including a deadline of up to 30 days or making three equal monthly instalments.

Similar to all traditional finance providers who offer products of this nature with the customers consent a hard credit check is undertaken. Well the answer is yes but Klarna say the credit check they carry out when you apply for most of their products is whats known as a soft search. But if you opt for the Klarna financing account you could be subject to a hard credit inquiry which could lower your credit scores by a few points.

When you use the basic pay later or pay in 30 days Klarna option to pay for your shopping a soft search will be run against your credit report. That means youll need to carefully consider how a financing plan will affect your score before choosing this option. Klarna doesnt set a minimum credit score to qualify for financing.

With pay later Klarna performs a soft credit check which doesnt appear on your file. In some cases you can be preapproved for Klarna financing plans which wont trigger a hard pull to your credit. Applying for one of our Financing options.

Missed payments can be filed with credit reference agencies.

Your Klarna And Pay In 4 Questions Answered Klarna Us

Your Klarna And Pay In 4 Questions Answered Klarna Us

3 Ways We Check You Can Afford To Use Klarna Klarna Uk

3 Ways We Check You Can Afford To Use Klarna Klarna Uk

Klarna Review How It Works How To Get Approved Creditcards Com

Klarna Review How It Works How To Get Approved Creditcards Com

3 Ways We Check You Can Afford To Use Klarna Klarna Uk

3 Ways We Check You Can Afford To Use Klarna Klarna Uk

Buy Now Pay Later How It Works Klarna Us

Buy Now Pay Later How It Works Klarna Us

Does Klarna Impact My Credit Score Klarna Uk

Does Klarna Impact My Credit Score Klarna Uk

Does Klarna Impact My Credit Score Klarna Uk

Does Klarna Impact My Credit Score Klarna Uk

Your Klarna And Pay In 4 Questions Answered Klarna Us

Your Klarna And Pay In 4 Questions Answered Klarna Us

Klarna 22 Key Facts You Need To Know Endless Gain

Klarna 22 Key Facts You Need To Know Endless Gain

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.