Measuring the Distribution of Taxes in Canada. In 201415 an average household in the top 10 paid nearly 38000 in taxes.

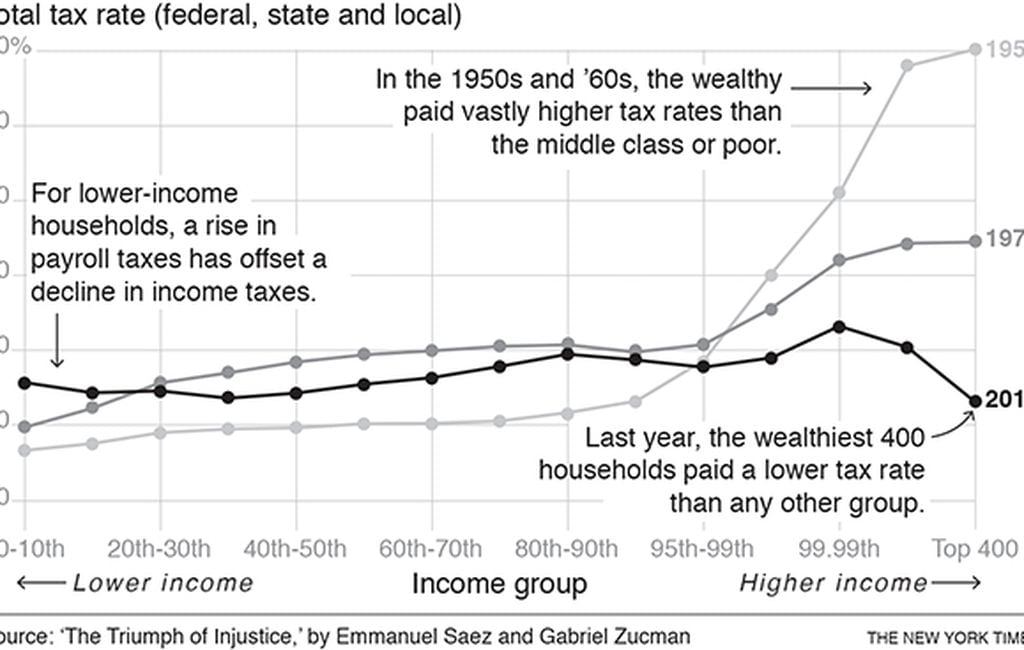

David Leonhardt The Rich Really Do Pay Less Taxes Than You Do

David Leonhardt The Rich Really Do Pay Less Taxes Than You Do

Has one of the most progressive systems of taxation in the world in which high-income people pay the highest tax rates.

How much do the rich pay in taxes. Those in the lowest income quintile earning up to 23000 for a single person actually get money back from the federal government. And the top 1 pay 373 of the total. For the next group up to 5 the fiscal pressure is just below a quarter.

Whats more the tax falls only on wage income. 21 trillion over 10 years Former President Donald Trumps signature tax bill lowered the corporate income tax rate to a flat 21 from a top rate of 35. But of that 525bn nearly a third of all tax raised was paid by the 381000 taxpayers who earn more than 150000 a year.

For the richest 1 the effective average tax rate is 272 meaning that well over a quarter of their income goes into. Looking at all federal taxes the. Why do the super-rich pay lower taxes.

The average federal income tax rate of the richest 400 Americans was just 20 percent in 2009. In fact by almost every measure the US. Today the top rate is 434.

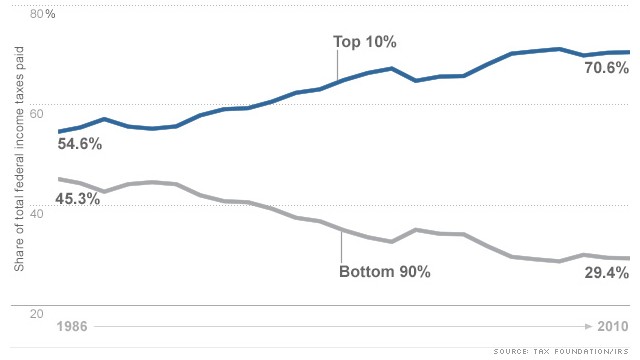

The share paid by the top 10 is hardly changing. Do the Rich Pay Their Fair Share. The richest 1 pay an effective federal income tax rate of 247 in 2014.

And the rich the top 1 of earners taking home 387000 or more pay 237. Those making 10 million a year pay an average income tax rate of 19. The tax paid by those 381000 individuals overwhelmingly male.

Someone making an average of 75000 is paying a 197 rate. Finds that this year the top 20 per cent of income earners in Canadafamilies with an annual income greater than 186875will earn 491 per cent of all income in Canada but pay 559 per cent of all taxes including not just income taxes but payroll taxes sales taxes and property taxes among others. Similarly in 2018 the top 01 percent of taxpayers paid 311 billion in income taxes.

So how exactly do the super rich hide that much money from the government every year. 70-100 billion is the estimated tax revenue lost each year due to loopholes. Taxpayers with incomes in the top 10 part with just over one-fifth 213 of their.

In 1980 when the highest income tax rate was 70 percent the richest 1 percent paid roughly 19 percent of the income tax. The payroll taxes that finance Social Security are flat for the first 132900 that a person earns and then the rate drops to zero percent. That may seem unfair.

How much more the rich would pay. In fact by almost every measure the US. The richest families also pay a lower rate than those in the upper middle class and even those in the top 1 who pay closer to 30 of their income in taxes.

Has one of the most progressive systems of taxation in the world in which high-income people pay the highest tax rates. There is broad support among millionaires for a wealth tax at the 50 million mark see above. Overall TPC finds that federal taxes are highly progressive with effective federal tax rates ranging from 29 percent for the lowest income 20 percent to 306 percent for the top 01 percent.

Tax rates for those making 1 million level out at 24 then declines for those making 15 million. Looking at all federal taxes the. In 2007 when the top tax rate was 35.

A household in the bottom 10 would have paid just over 5000. While middle-class earners in the fourth quintile with income of 58000 to 89000 for singles pay a rate of 67. And the top 1 pay 373 of the total.

As a group they contributed about 27 of all taxes paid. So their 40 percent share of income taxes is twice their share of the nations income. But that support decreases significantly if the wealth tax kicked in at 10 million and therefore impacted more people.

In case you are thinking Well the rich make more they should pay more the top 1 percent of taxpayers account for 20 percent of all income AGI. Last October Bloomberg reported that the top half of taxpayers pay 97 of all federal income tax. Individuals in the top 1 percent of earners paid more than 538 billion in income taxes in 2016 more than the bottom 90 percent of payers combined.

For The First Time In History U S Billionaires Paid A Lower Tax Rate Than The Working Class The Washington Post

For The First Time In History U S Billionaires Paid A Lower Tax Rate Than The Working Class The Washington Post

/cdn.vox-cdn.com/uploads/chorus_asset/file/19335777/pasted_image_0_1.png) How Much Do The Rich Pay In Taxes Vox

How Much Do The Rich Pay In Taxes Vox

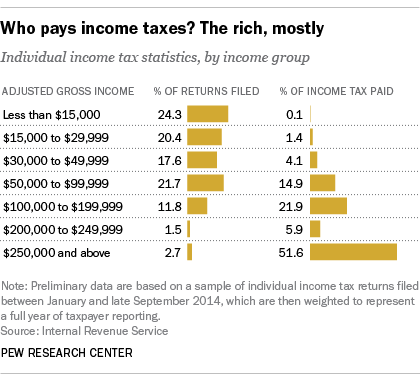

High Income Americans Pay Most Income Taxes But Enough To Be Fair Pew Research Center

High Income Americans Pay Most Income Taxes But Enough To Be Fair Pew Research Center

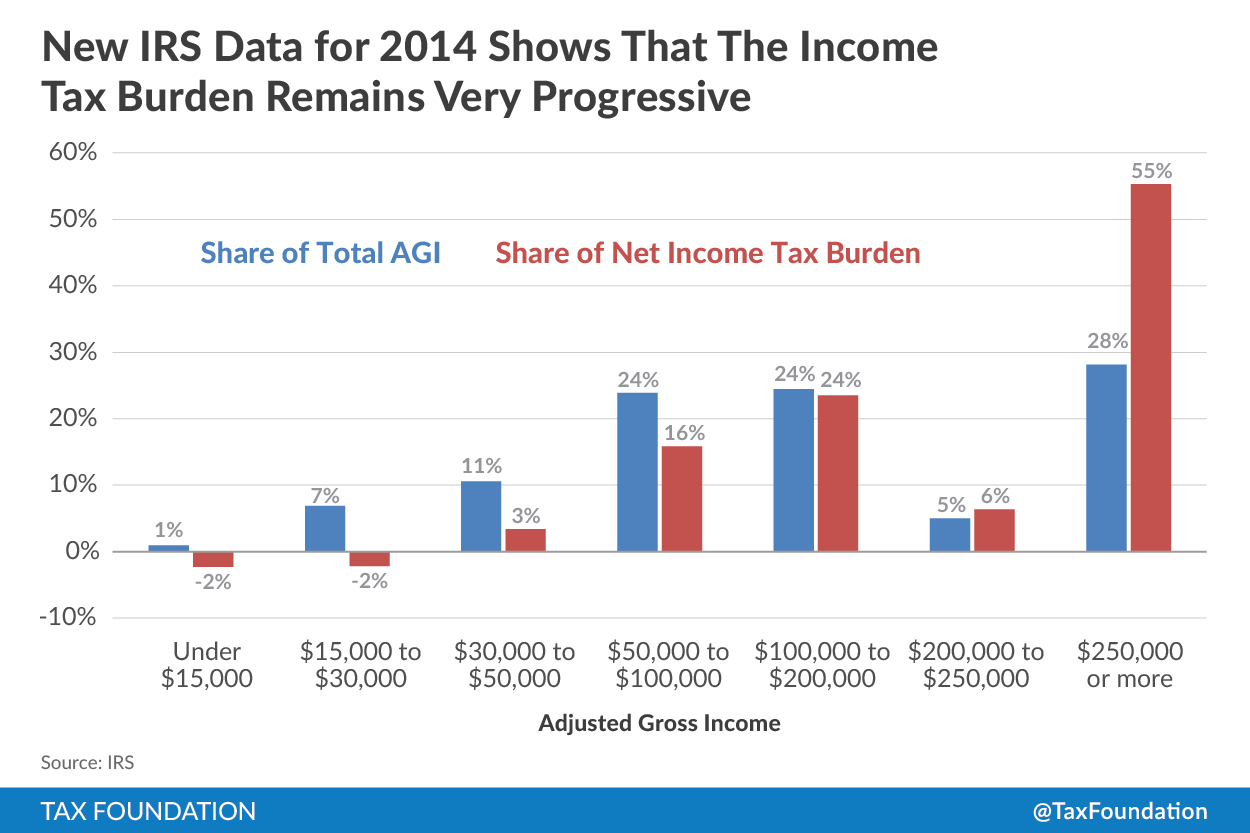

Summary Of The Latest Federal Income Tax Data 2018 Update

Summary Of The Latest Federal Income Tax Data 2018 Update

In 1 Chart How Much The Rich Pay In Taxes The Heritage Foundation

In 1 Chart How Much The Rich Pay In Taxes The Heritage Foundation

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

How Much Do The Rich Really Pay In Taxes Money

How Much Do The Rich Really Pay In Taxes Money

How Much Do The Top 1 Percent Pay Of All Taxes

New Irs Data Wealthy Paid 55 Percent Of Income Taxes In 2014 Tax Foundation

New Irs Data Wealthy Paid 55 Percent Of Income Taxes In 2014 Tax Foundation

The Rich Pay Majority Of U S Income Taxes

The Rich Pay Majority Of U S Income Taxes

Do The Rich Pay More Or Less In Taxes

Do The Rich Pay More Or Less In Taxes

Who Pays Taxes In America In 2019 Itep

Who Pays Taxes In America In 2019 Itep

/cdn.vox-cdn.com/uploads/chorus_asset/file/19335637/Screen_Shot_2019_10_31_at_2.11.00_PM.png) How Much Do The Rich Pay In Taxes Vox

How Much Do The Rich Pay In Taxes Vox

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.