Dividends interest and rental income. Income attributable to a Polish permanent establishment is generally taxed at 19 rate through a tax.

Simple Tax Guide For Americans In Poland

Simple Tax Guide For Americans In Poland

In the OECD and most of the world the value-added tax VAT is the most common consumption tax.

Taxes in poland. Your Payroll Options in Poland. The excise tax is charged in case of a number of selected goods and shipping companies in Poland have the option to choose to pay the tonnage tax in case of certain types of income. 150 for overtime work performed on any day other than those referred to in subsection 1.

Polish tax residents are subject to tax on their worldwide income. Non-resident companies are taxed only on income derived from Polish sources. The 2018 tax rate for an individual is 18 or 32.

The calculator is for reference only. The first 3091 zlotys earned in the year are free of tax while income exceeding this figure but lower than 85528 zloties is taxed at 18 percent. In 2017 the top personal income-tax rate is levied on earnings above 85528 Polish zloties per year and it amounts to 32 percent.

Moreover different type of tax. EUR 5 per square meter of usable area. In 2017 the land plot used for business purposes is subject to a RET rate of 089 PLN approximately 02 Euros per square meter while for buildings used for business purposes RET is subject to a rate limit of 2266 approximately 5 Euros per.

Individual tax account tax micro account in Poland As of 1st January 2020 Polish taxpayers will be obligated to pay VAT PIT CIT only on their individual tax account in Poland. Individuals with their place of residence in Poland are taxed on their total income regardless of where the income is earned unlimited tax obligation in Poland. There is no payroll tax or worthnet wealth tax in Poland.

Polands taxation of an individuals income is progressive. The individual not conducting business activity may choose one of two existing forms of taxation of rental income. The general list of taxes on corporations also includes the real property tax the transfer tax and stamp duty.

Polish company tax rate for 2010 is 19. Non-residents are taxed only on their Polish-sourced income. Start your adventure with business.

The tax authorities right to tax a non-resident is further limited if the non-residents country of residence concluded a DTT with Poland. Consumption Taxes in Poland Consumption taxes are charged on goods and services and can take various forms. Real estate tax rates RET in Poland are defined by the taxes and fees set by municipalities under the Local Law.

Dividends and interest are subject to a 19 percent flat rate final tax. The assumption is that the employee is employed full-time and there are no additional charges. Rental income is subject to tax in Poland.

12 Feb 2021. Deal with all business matters on biznesgovpl. In Poland real estate tax RET rates are set up by municipalities within limits specified by the Law on Local Taxes and Fees.

PLN 467456 PLN 8582800 32. EUR 02 per square meter while buildings used for business purposes are subject to RET at a rate limit of PLN 2266 approx. Taxed Taxable 0 - PLN 8582800 18.

Unlimited tax obligation in Poland. Polish resident companies are subject to corporate income tax CIT for all sources of their income while non-residents are subject to income tax only on income derived from the territory of Poland. In other words the higher the income the higher the rate of tax payable.

While there is no payroll tax in Poland foreign companies are required to comply with Polish tax laws primarily in regards to individual income tax social security withholding tax and sales tax. Last partial update June 2018. Namely they are taxed at a flat rate of 20 calculated on revenue cost deductions are not allowed unless a DTT between Poland and the individuals country of residence provides otherwise.

Now taxes are paid to the bank accounts of Polish tax office competent for the taxpayer. Instead of paying for overtime employers may. In 2017 land used for business purposes is subject to RET at a rate limit of PLN 089 approx.

These types of earnings include the following. Individuals who do not have a place of residence in Poland are taxed solely on income earned in Poland limited tax obligation in Poland. The Company shall be deemed to be resident in Poland if it is incorporated or managed in Poland.

On a non-working day granted to an employee in exchange for work performed on a Saturday or a holiday. Our 2021 payroll calculator allows companies and employees to estimate a net salary and total cost of labor including personal income tax owed PIT social security contributions and other taxes. How does it look now.

They are generally taxed according to the rules applicable to residents.

Polish Tax Laws Fighting A Winning Battle Against Tax Evaders Emerging Europe

Polish Tax Laws Fighting A Winning Battle Against Tax Evaders Emerging Europe

Do We Have High Taxes In Poland Michal Cwiok

Do We Have High Taxes In Poland Michal Cwiok

Poland Distributional Impact Of The Tax And Benefit System In 2014 Download Scientific Diagram

Poland Distributional Impact Of The Tax And Benefit System In 2014 Download Scientific Diagram

Poland Taxing Wages 2020 Oecd Ilibrary

Poland Taxing Wages 2020 Oecd Ilibrary

Polish Tax System Is Becoming Less Complicated But Still Needs Reforms

Simple Tax Guide For Americans In Poland

Simple Tax Guide For Americans In Poland

Differences In Tax System In Poland And In German Speaking Countries Germany Austria Switzerland Ppt Download

Differences In Tax System In Poland And In German Speaking Countries Germany Austria Switzerland Ppt Download

Income Tax Rates In Poland Download Table

Income Tax Rates In Poland Download Table

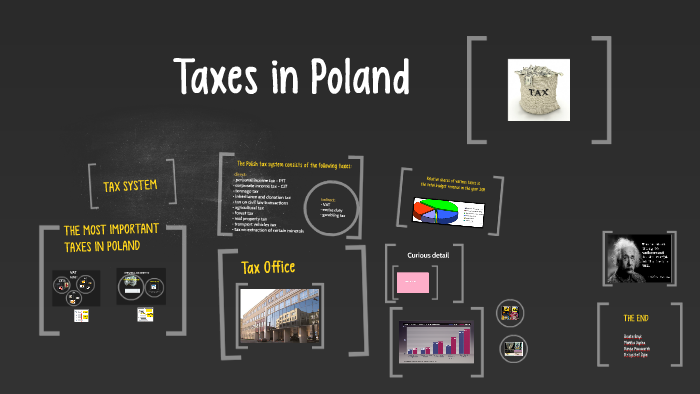

Taxes In Poland By Monika Dycha

Taxes In Poland By Monika Dycha

Do We Have High Taxes In Poland Michal Cwiok

Do We Have High Taxes In Poland Michal Cwiok

Baker Mckenzie S Doing Business In Poland Chapter 5 Tax System

Baker Mckenzie S Doing Business In Poland Chapter 5 Tax System

Political Economy Of Vat In Poland 4liberty Eu

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.