The Sunk Cost Dilemma is additionally called the Concorde Fallacy. The sunk cost fallacy is most dangerous when we have invested a lot of time money.

How The Sunk Cost Fallacy Wreaks Havoc On Your Money And Your Mind Sunk Costs Opportunity Cost Behavioral Economics

How The Sunk Cost Fallacy Wreaks Havoc On Your Money And Your Mind Sunk Costs Opportunity Cost Behavioral Economics

And what is the Sunk Cost Trap or the Sunk Cost Fallacy.

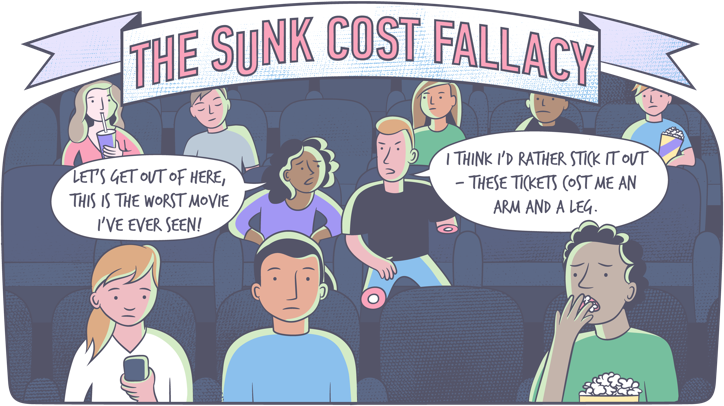

What is sunk cost fallacy. However there is also the axiom of throwing good money after bad This is known as the sunk cost fallacy which is an error in reasoning that the decision maker should avoid. Sunk Cost Fallacy Examples. The sunk cost fallacy occurs when people continue investing time and resources into something because they are afraid of losing everything if they stop that behavior.

We believe that because we have sunk that. For example a business may have invested a million dollars into new hardware. Therefore such a cost is irrelevant for making decisions for the future.

The value at present is zero because it is incomplete and no sale or recovery is feasible. Sunk cost dilemma is an emotional difficulty to decide whether to continue with the projectdeal. Energy or love in something.

In business an example of sunk costs may be investment into a factory or research that now has a lower value or no value whatsoever. The sunk cost fallacy occurs when we are unable to cut our losses due to the past money or time we have spent on an an activity. A sunk cost fallacy is often simplified to the idea of throwing good money after bad while refusing to cut ones losses.

This money is now gone and cannot be. What is this fallacy. This fallacy often leads to irrational.

Sunk cost fallacy also known as Concorde fallacy is an emotional situation where the. In sunk cost theory we will often decide to stay with something because weve put time or resources into it. This cost incurred as sunk cost expense and debited under the profit and loss account.

The Sunk Cost Dilemma is a formal monetary term that portrays the trouble of deciding whether to continue with an investment or desert it when the time and cash have been spent and the ideal outcomes have not yet been accomplished. The more we invest the greater the sunk costs are and the greater the urge to continue becomes. This investment becomes a reason to carry on even if we are dealing with a lost cause.

The term sunk cost fallacy describes a common situation in human behavior in which sunk costs influence decision-making despite the fact that they have already been spent and are not recoverable. The sunk cost fallacy is one of the more frequent delusions wh. These types of costs are also sometimes known as retrospective costs as opposed to prospective costs which could be altered based on different actions being taken.

In economics a sunk cost is any past cost that has already been paid and cannot be recovered. Sunk cost fallacy is when we feel committed to an endeavor and compelled to keep going because of prior investment despite lack of return. Chances are good that even if you pride yourself on being rational most of the time you still occasionally fall for the sunk cost fallacy.

As it has already been done thats why it is known as historical cost or past cost. Examples of Sunk Cost Fallacy. For example 20 million has been spent on building a power plant.

Sunk costs are expended costs that cannot be recovered by the project. Sunk cost is that cost that has been gone out of your pocket and cannot come back. And How it Can Affect Your Decisions.

Much of our decision making is focused on how and where to invest our time money and effort. Sunk cost dilemma in. Sunk Cost is a concept that is important to project management and in this.

What is sunk cost and the sunk cost fallacy. In other words people are likely to continue spending money on something to sustain it if they have previously invested money into it. Investors frequently fall victim to the sunk cost fallacy.

Instead of making the rational choice to maximize our utility at the present time we end up trying to regain the time or money we have already lost by continuing to spend more time or money. For instance a person who buys a book and begins reading it may find out that she does not enjoy it. Jim Semick Co-Founder of ProductPlan explains it this way.

Sunk Cost Fallacy The Psychology Of Money Series Philstar Com

Sunk Cost Fallacy Forever Jobless

Sunk Cost Fallacy Forever Jobless

The Sunk Cost Fallacy What Is It And Why Does It Happen Youtube

The Sunk Cost Fallacy What Is It And Why Does It Happen Youtube

Leveraging The Sunk Cost Fallacy How The Sunk Cost Fallacy Be Leveraged By Sajid Khetani Sknotes

Sunk Cost Fallacy Know When You Need To Pull The Plug Techtello

Sunk Cost Fallacy Know When You Need To Pull The Plug Techtello

It S 9 P M Do You Know Where Your Treadmill Is Under The Pile Of Laundry Duh The Sunk Cost Fallacy And Fitness Hard Working Man Sunk Costs You Know Where

It S 9 P M Do You Know Where Your Treadmill Is Under The Pile Of Laundry Duh The Sunk Cost Fallacy And Fitness Hard Working Man Sunk Costs You Know Where

Ameer Rosic On Twitter The Sunk Cost Fallacy Is Most Dangerous When We Have Invested A Lot Of Time Money Energy Or Love In Something This Investment Becomes A Reason To Carry

Ameer Rosic On Twitter The Sunk Cost Fallacy Is Most Dangerous When We Have Invested A Lot Of Time Money Energy Or Love In Something This Investment Becomes A Reason To Carry

Sunk Cost Fallacy Sunk Costs Logical Fallacies Critical Thinking Skills

Sunk Cost Fallacy Sunk Costs Logical Fallacies Critical Thinking Skills

The Sunk Cost Fallacy The Big Picture

The Sunk Cost Fallacy The Big Picture

Beware Of The Sunk Cost Fallacy When Planning Your It Investments

Beware Of The Sunk Cost Fallacy When Planning Your It Investments

Sunk Cost Fallacy Why You Make Stupid Mistakes Easily

Sunk Cost Fallacy Why You Make Stupid Mistakes Easily

Sunk Cost Fallacy Know When You Need To Pull The Plug Techtello

Sunk Cost Fallacy Know When You Need To Pull The Plug Techtello

How To Overcome The Sunk Cost Fallacy Mindset To Improve Your Life

How To Overcome The Sunk Cost Fallacy Mindset To Improve Your Life

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.